Talk about walking into a shitstorm created by your predecessor.

(,

Wed 1 Apr 2009, 15:01,

archived)

It's very hard to blame the last guy, when the last guy is in charge.

(,

Wed 1 Apr 2009, 15:05,

archived)

which cowboy have you had in here...? Well - it's all fucked for a start, s' gonna take about £1.5tn to put it right...

(,

Wed 1 Apr 2009, 15:06,

archived)

The British (European ) financial situation has nothing to do with Gordon Brown as an individual ( he was the single most successful chancellor we have ever had ) But is a direct result of the 18 month knock on we get from the debt based monetarism system of the US, the US banks greed in the subprime market ( and subsequent devaluation of bonds ) coupled with hedge fund managers in the world markets taking every advantage of the situation to make huge quick profits with no consideration to the effect it would have on inflation.

But of course it's easier to 'blame the government'.

(,

Wed 1 Apr 2009, 15:25,

archived)

But of course it's easier to 'blame the government'.

Whilst riding a boom in assets such as houses.

I don't think it was mostly his fault, but it would have been nice for him or some of the system he created to regulate the banking industry to look a bit more closely at what was going on.

(,

Wed 1 Apr 2009, 15:28,

archived)

I don't think it was mostly his fault, but it would have been nice for him or some of the system he created to regulate the banking industry to look a bit more closely at what was going on.

They've got to be prepared to take responsibility for the bad times.

* no pun intended, much

(,

Wed 1 Apr 2009, 15:35,

archived)

* no pun intended, much

to individuals when they had absolutely no control or responsibility for the people who started this. If you must blame a government ( rather than the private finance sector who are to blame ) then you have to look at the Bush administration rather than tilting at windmills and blaming people who could do nothing about it.

(,

Wed 1 Apr 2009, 15:41,

archived)

Also, it's equally unfair for individuals to take credit for the good times when they weren't directly responsible for those, either.

(,

Wed 1 Apr 2009, 15:55,

archived)

They lent money to the world to buy chinese goods on credit, then pulled the money back to collapse the markets, now they are slowly buying shares at knock-down prices. They are the worlds keenest gamblers!

(,

Wed 1 Apr 2009, 15:41,

archived)

and I can't get decent hardwood to save my life. the bastards.

(,

Wed 1 Apr 2009, 15:43,

archived)

www.timbmet.com/

probably biggest hardwood dealers in the UK

(,

Wed 1 Apr 2009, 16:04,

archived)

probably biggest hardwood dealers in the UK

you sign up immediately and max it out?

Just because they're offering a loan doesn't mean we needed to take it

(,

Wed 1 Apr 2009, 15:44,

archived)

Just because they're offering a loan doesn't mean we needed to take it

You need to liquidise any assets you can and get it into savings. Savers will do well out of this.

(,

Wed 1 Apr 2009, 15:46,

archived)

I'll be shopping around soon.

On the plus side, I'm saving for a deposit and house prices are coming down while my money goes up (slowly).

(,

Wed 1 Apr 2009, 15:47,

archived)

On the plus side, I'm saving for a deposit and house prices are coming down while my money goes up (slowly).

There are two houses in our area that are at around 50% of their 2007 value and whilst we'll not see that kind of recovery I think that there will be a tidy profit in both of them.

(,

Wed 1 Apr 2009, 15:50,

archived)

It seems short sighted at best for people to have thought that steeply rising house prices were a good thing.

(,

Wed 1 Apr 2009, 15:54,

archived)

I'll see what I can get elsewhere first. Most of it's living in an ISA anyway.

(,

Wed 1 Apr 2009, 16:00,

archived)

(or at least you used to, it's years since I had any, actually)

..but at the time it was at least equivalent to having savings with a decent interest rate, with just a chance of getting really lucky...

(,

Wed 1 Apr 2009, 16:02,

archived)

..but at the time it was at least equivalent to having savings with a decent interest rate, with just a chance of getting really lucky...

www.moneysavingexpert.com/savings/premium-bonds-calculator/

I'll look into it, but with people being paranoid about banks, I think the odds are getting worse at the moment.

(,

Wed 1 Apr 2009, 16:05,

archived)

I'll look into it, but with people being paranoid about banks, I think the odds are getting worse at the moment.

The only person making money from moneysavingsexpert is martin lewis. the twunt.

(,

Wed 1 Apr 2009, 16:09,

archived)

and should have no problem getting over 3% on 12 months bonds.

www.lovemoney.com/savings/term-bond-accounts.aspx

(,

Wed 1 Apr 2009, 16:06,

archived)

www.lovemoney.com/savings/term-bond-accounts.aspx

I'll probably look for a decent 1-year thing. Cheers for the link.

(,

Wed 1 Apr 2009, 16:09,

archived)

I agree that they will go up. It's just that with a fixed rate bond your profit is guaranteed. You can already find better rates but being index linked they are really risky right now.

(,

Wed 1 Apr 2009, 16:15,

archived)

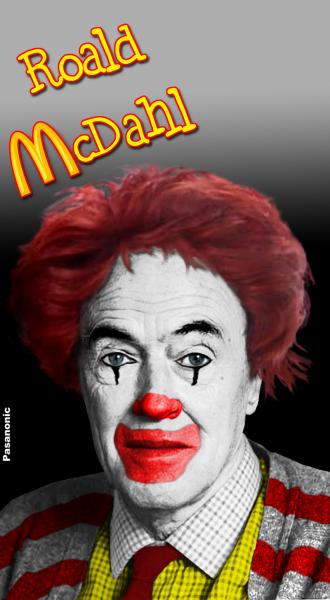

What are his policies on fast food?

(,

Wed 1 Apr 2009, 15:02,

archived)